With news of slowing global deal volume and tighter capital conditions, many SME owners are asking the same question: “Will I still get a good price if I sell now?”

The short answer: Yes — if your business has the fundamentals buyers want.

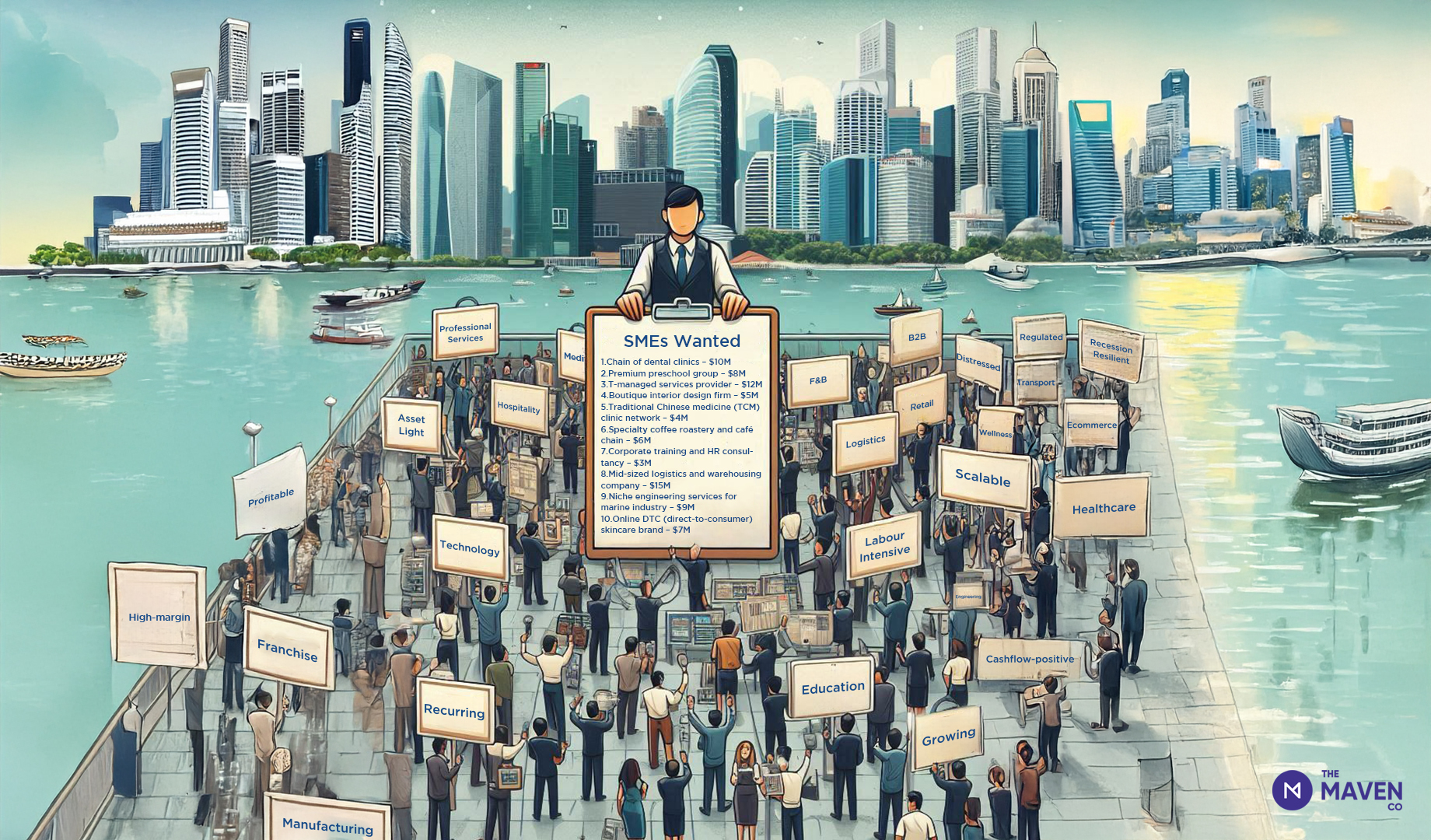

Despite economic headwinds, deal activity in Southeast Asia remains relatively resilient. Valuations are slightly lower at the top end, but quality small and mid-sized businesses are still seeing strong interest and competitive offers. In Singapore in particular, healthy demand continues across certain industries like B2B services, logistics and specialty manufacturing, as well as evergreen ones such as education and healthcare.

What Buyers Are Looking For

Buyers today are more selective, but also more serious. Here are the key traits of businesses that are still commanding premium multiples:

- Recurring or repeatable revenue (e.g., retainer clients, subscriptions, long-term contracts)

- Strong gross margins and good cost controls

- Scalable operations that don’t depend heavily on the owner

- Digital enablement (integrated systems, automated workflows, data-driven decision making)

- Strong market position or unique selling proposition that differentiates it from competitors

In short: buyers want growth potential, sustainability, and low transition risk.

Real Deals We’re Seeing

In Q2 2025, we’ve seen SME deals in Singapore closing between 3x to 7x EBITDA, depending on sector, size, and transferability. Businesses under $5M revenue are generally seeing tighter ranges, unless they bring something truly strategic to the table (e.g., a market niche, unique customer base, or strong operational leverage).

What This Means for You

If you’re an SME owner considering an exit in the next 1–2 years, the smart move is to:

- Get professional help – deal advisors with strong M&A capabilities will create more value for you than if you try to do it on your own

- Start getting your house in order – prepare your financials and team structure

The key is to focus on what makes your business transferable and desirable beyond the numbers.

Curious what your business might be worth in today’s market? Contact Us today for a complimentary valuation of your business.